A contract manufacturer (CM) is a company that takes over parts of the production process of another company, operating under a mutually beneficial service agreement. In today’s global business landscape, selecting a CM can be an involved and lengthy process. It is not only about selecting the best price offer or the most helpful crew of people to delegate manufacturing tasks to; many factors need to be taken into account in order to make a strategic choice.

This article provides an outline of what needs to be taken into account when choosing a contract manufacturer and a handy spreadsheet template for comparing both pricing and qualitative factors.

How Contract Manufacturing Works

A contract manufacturing business model is based on an agreement called the Manufacturing Services Agreement (MSA). The hiring firm selects a number of candidate production companies and approaches them with a request for quotation (RFQ) on their product. Manufacturers then provide their price offers for all components involved, and a fixed price is negotiated for a set quantity of produced goods.

This is based on the CM’s available personnel, equipment, materials, tooling, and shipping options. If agreed upon, the CM may also outsource the manufacturing of some parts of the bill of materials (BOM) to subcontractors. In essence, working with a contract manufacturer is a way to hire an off-site factory.

How to Choose a 3D Printing Technology

Having trouble finding the best 3D printing technology for your needs? In this video guide, we compare professional 3D printers across popular buying considerations.

Why Outsource Production to a Contract Manufacturer?

Companies delegate their production process to a CM for a number of reasons:

-

Lower costs: Building a factory incurs extremely high costs, which means that hiring a CM is often the only way to start production, especially for startups. Many CMs are based in China, India, and Southeast Asian countries where labor costs can be up to ten times lower compared to the USA or Europe. Producing in China is especially attractive for large product volumes that require conventional manufacturing technologies like injection molding, products that require substantial amounts of labor for assembly, are not IP-sensitive, and have tolerant shipping deadlines.

-

Time to market: Building your own factory from scratch can easily take years. CMs already have the facilities fitted with most of the equipment and employees, so setting up production can be done in a few months.

-

Simplification: Outsourcing production means that the firm does not have to build out expertise in order to set up and run a production line. Instead, it frees up internal resources so that it can now focus on its core competencies, for example, research and development or branding and marketing.

-

Efficiency: Choosing a manufacturing partner that can take care of all components of your product under one roof streamlines the supply chain and prevents complex planning and unnecessary delays.

-

Quality control: Many factories, especially in Europe and the USA, are certified to operate under strict quality regulations. This ensures high quality of parts and prevents extra revisions needed to meet compliance standards that can cost tens of thousands of dollars at that stage.

-

Expertise: The best CMs will be excited to develop a product towards the production-ready stage and will offer technical advice, design for manufacturing (DFM) support, and non-recurring engineering (NRE) services. When opting for an ODM (Original Design Manufacturer), the hiring firm will have an extra development team at its disposal. They will also assist in technical issues such as material selection, mold construction, and assembly plans.

-

Variable demand: The holy grail of contract manufacturing is the ability to scale batch sizes to any preferred number. Each MSA will cover an agreed product quantity. When the relationship is fruitful, it is easy to order new batches at the same manufacturer depending on the demand. Often CMs will provide discounts based on minimum order quantity (MOQ) or estimated annual usage (EAU). A typical large factory in China will start at 5,000 units and/or aim for a total production of about one million US dollars per year for each customer.

The Risks of Outsourcing to a CM

While there are benefits to outsourcing production to a CM, there are also some risks associated:

-

Product changes: The product as specified in the BOM, drawings, and prototypes cannot always be manufactured as is by the CM’s equipment and staff. Depending on the project, the CM may slightly change the CAD model, or develop their own version of it to make it easier and more cost-effective to produce. It is imperative to discuss the most important design features before finding out that a draft angle, snap feature, or color has suddenly deviated from the expected result.

-

Quality deviations: It is important to verify whether or not your CM can produce and test to meet compliance standards such as UL, ETL, CSA, CE, ROHS, and FDA regulations. Preventing future revisions at an early stage means saving the bulk of the costs. It is equally important to agree on mold standards, especially if you are looking to hand over the mold to a factory abroad when scaling up at a later stage.

-

Copycats: Even if an NDA is signed concomitantly with the MSA, it is relatively easy for a factory employee to steal sensitive information, even to copy the product for their own market. To prevent this, it is paramount to visit the factory and be immersed in the corporate culture, and to be careful in sending native CAD files and use conversion formats such as IGES and STEP instead. Sometimes components are sent out separately for quotes by different suppliers in order to keep the complete product assembly proprietary, however, it is a better practice to go the extra mile and find a trustworthy CM to take care of the entire production process.

-

Long lead time: 90-day lead time for a product sourced from Asia is not uncommon and ocean freight takes at least a month. Air freight is fast but costly to the company and the planet. Shipping by train is a better alternative where the infrastructure exists. Also, because control is delegated to the CM, it is difficult to manage disruptions in the supply chain. Language barriers and cultural differences can also potentially delay the process. Take the Chinese New Year for example. Advertised to last about three weeks starting mid-February, in practice, employees leave to visit their families anywhere within a six-week stretch. This is a period of great unpredictability business-wise, so make sure to align the project planning well.

-

Intransparent pricing: With contract manufacturing, two organizations have to make a profit instead of one. This can add to the COGS of the final product. Factories often charge an additional fee for labor, overhead, and profit (LOP). It can be as high as 30% of the originally quoted price. In case the buyer takes responsibility for transportation, there are additional shipping costs. Finally, take into account the cost for samples, first shots (FS), and/or engineering pilot (EP) tooling which occur before production starts (PS).

-

Long-term relationship: Contract manufacturers appreciate a long-lasting business relationship and will expect an order for follow-up batches and future projects. They will prioritize partners that promise continuous collaboration.

-

Distance: A trip to a CM in China can take anywhere between 12 to 48 hours departing from the USA or Europe. A weeklong trip for factory visits will set your company back approximately USD 2,000 to 5,000 per person.

-

Culture shock: One of the greatest barriers to success abroad is not respecting cultural and business practices. It is important not to compare the new country to the home country, but to invest time to understand how things work. The importance of consensus and hierarchy, for example, vary across nations. In Asia, face-to-face relationship building is a must that takes time. In order not to ‘lose face,’ people will tend to avoid direct confrontation and saying ‘no.’ As such, a ‘yes’ should be taken as acknowledgment rather than agreement. To maintain a good ‘face,’ a firm may also send out their best English speaker rather than the most representative senior or best negotiator. This can cause unpredictable bottlenecks in the process of setting up a deal. There are etiquette rules for having dinner, greeting, exchanging business cards, where to sit in the room, and formal dress codes. For those doing business in the region for the first time, it is advisable to hire an interpreter or native speaking advisor to bridge the cultural and language gap.

The Five Steps to Selecting a Contract Manufacturer

1. Where to Find Contract Manufacturers

As your product becomes more defined in consecutive stages of prototyping, it is time to find candidates for the right contract manufacturer. There are several online portals but more direct links can be established by inquiring into personal networks and visiting trade shows.

Here is a list of popular ways to find the right CM:

-

Trade shows, such as the legendary Canton Fair in China, the Hannover Messe in Germany, IMTEX India, and MODEX USA

-

Manufacturing consultancy companies, such as Dragon Innovation

-

Online

-

Alibaba, the largest global manufacturing marketplace. Short communication lines and open to everyone.

-

Better Business Bureau, for a critically assembled list of responsible businesses.

-

Europages, a European B2B marketplace.

-

Kompass, a worldwide B2B manufacturer listing

-

Made In China, for Chinese suppliers of components.

-

MFG.com. Custom manufacturing marketplace.

-

Yellow Pages for companies in the USA.

-

Yell for companies in the UK.

-

Rosfirm, products and suppliers from Russia.

-

Solostocks, for products and providers from Latin America.

-

-

Your personal network

2. Qualitative Evaluation

After the orientation phase, select five to ten potential CMs to partner up with. Besides going by the overall impression, this is best done by establishing a supplier selection criteria. The team will decide on the importance of each criterion, and subsequently, potential CMs will be rated according to a decision matrix.

The selection criteria may include:

-

COGS / total cost: Take into account tooling, samples, prototypes, pilot series, OEM part purchases, customization, packaging, shipping, duties, and payment terms. If the total cost is lower than increasing labor and utilities in-house, it is wiser to outsource.

-

Company size fit: A CM might not be ready to handle your project if you are their largest client. On the other hand, if you are their smallest client, they may not prioritize the project.

-

Product portfolio: Congruence in overall vision, industry, and product portfolio. If the CM has built products similar to yours, they’ll more likely do a better job producing your product.

-

Communication: Does a CM respond to emails in a timely manner? Is it easy to organize conference calls? Are there significant language barriers? If the communication is complicated already at an early stage, it’s a sign that it’ll be complicated to solve issues down the line.

-

Relationship: If it is your company’s first time doing business in the region or with a certain CM, consider how much of a culture shock and time-investment it may be to establish a new relationship.

-

Scale-up potential: Important factors are automation, company size, volume discounts, and room for facility expansion in case of growing demand.

-

Shipping: Consider shipping alternatives to the specific regions where your products will most likely be sold.

-

Supply chain: Can the CM produce most components under one roof? Can they source all parts easily from the region? Include components, chassis, enclosure, PCBA, software, packaging, cabling, and documentation.

-

Equipment: Does the CM have the right equipment to produce your product? It doesn’t always have to be state-of-the-art, but do they have the required technologies for production, post-processing, assembly, etc.? Do they have well-documented maintenance and calibration schedules? How well is the inventory managed? Is the equipment shared across multiple projects? Can they do the ‘fire fighting’ necessary in case of adverse events? Do they have the expertise to take full advantage of the shop floor’s potential? Do they have good training programs for shop workers?

-

Quality: Adherence to quality standards such as the ISO 9001 as well as CMF specification systems such as Pantone for colors, and SPI, Mold-Tech, YS, and VDI for texture finish.

-

Additional services: Some CMs offer assistance with DFM, cost reduction, product optimization, component sourcing, and more.

-

IP: Safety of intellectual property.

-

Political risk: Raised tariffs or other barriers due to international trade wars.

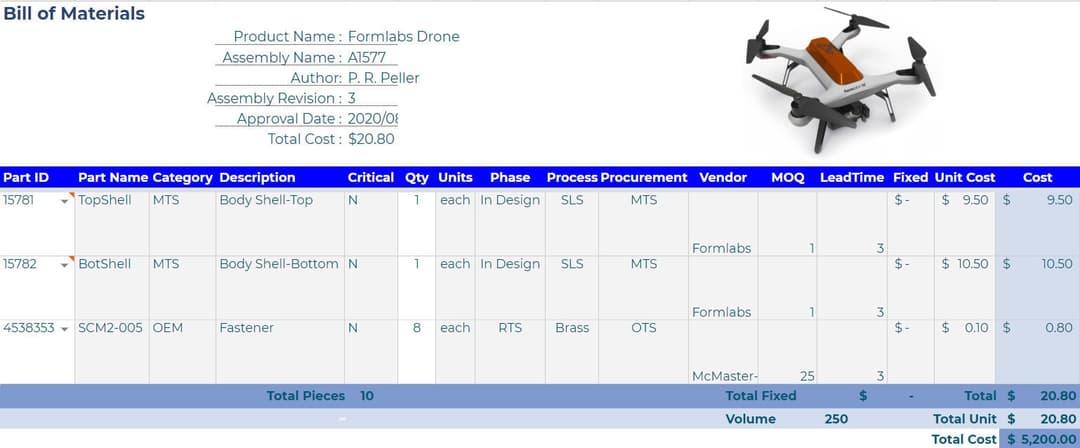

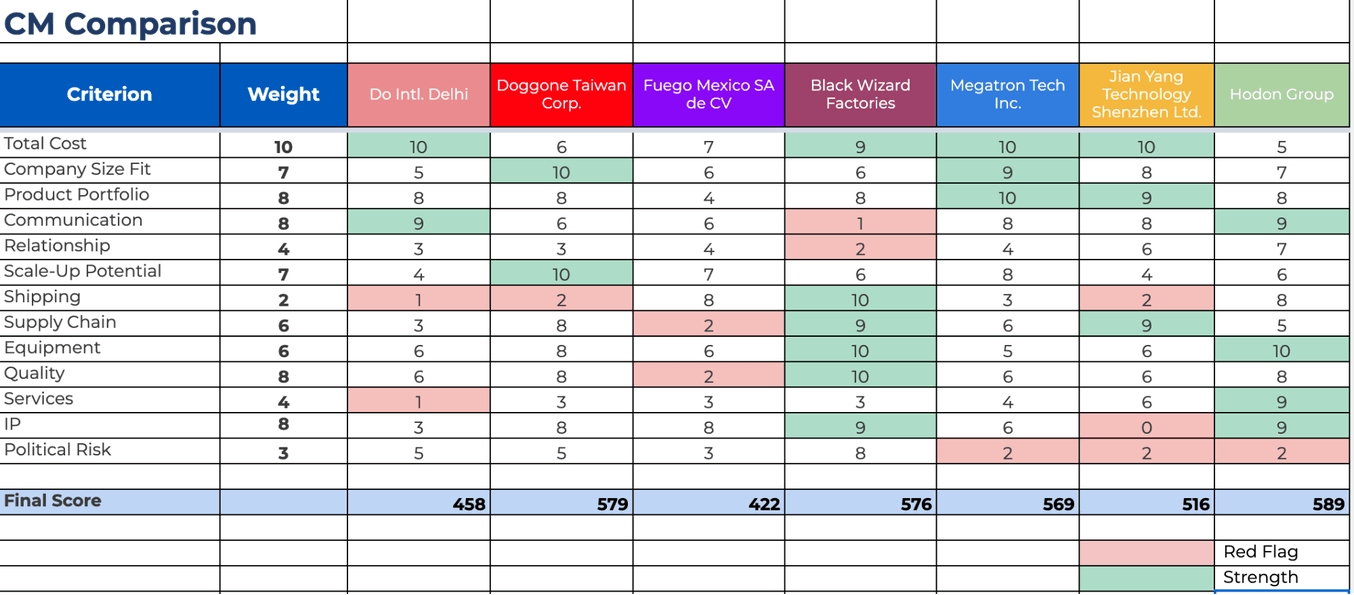

We created an example of a comparison matrix that is coupled to a fictive BOM of Apple’s Airpods Pro—the same BOM template we used in our guide to the bill of materials.

In the sheet named ‘CM Comparison’, potential manufacturing partners are ranked according to different criteria with various weights depending on their importance. This provides an overview and can help put an end to biased opinions due to overvaluing factors such as lowest cost, being the largest CM, or having the most attractive corporate culture. The process can be democratic by involving senior members of the management and the development teams to determine the selection criteria and their respective importance.

A comparison also helps to point out potential red flags. For example, even though the fictive Black Wizard Factories scored third highest and offered all capabilities, they should be eliminated from the process due to the inflexibility of communication. With its short communication lines, cutting-edge equipment, automation possibilities, and outstandingly pro-active corporate culture, the fictive Hodon Group would be the best choice according to this chart.

3. Sending out Requests for Quotation (RFQ)

Out of an initial list of five to ten contract manufacturer candidates, requests for a quote are typically sent to the top three to five of them after signing NDAs. For large projects it is not enough to only send out the CAD data; an RFQ needs to contain detailed descriptions for the CM to get a good understanding of the project.

The document starts with the equivalent of a cover letter that provides an overview of the company, the team, funding, a description of the product, its state of development, as well as what needs to be done by the CM. It also lists several criteria that the factory is to meet.

The second part of the RFQ contains as much information about the product as possible: a BOM spreadsheet, drawings, CMF specifications, a prototype, Gerber files in case of electronics, and intended margins. 3D printed prototypes can also be great tools to communicate the intent of product design to a factory.

Lastly, the request should include a time schedule for all milestones involved in the road to production.

4. Negotiating Quotes

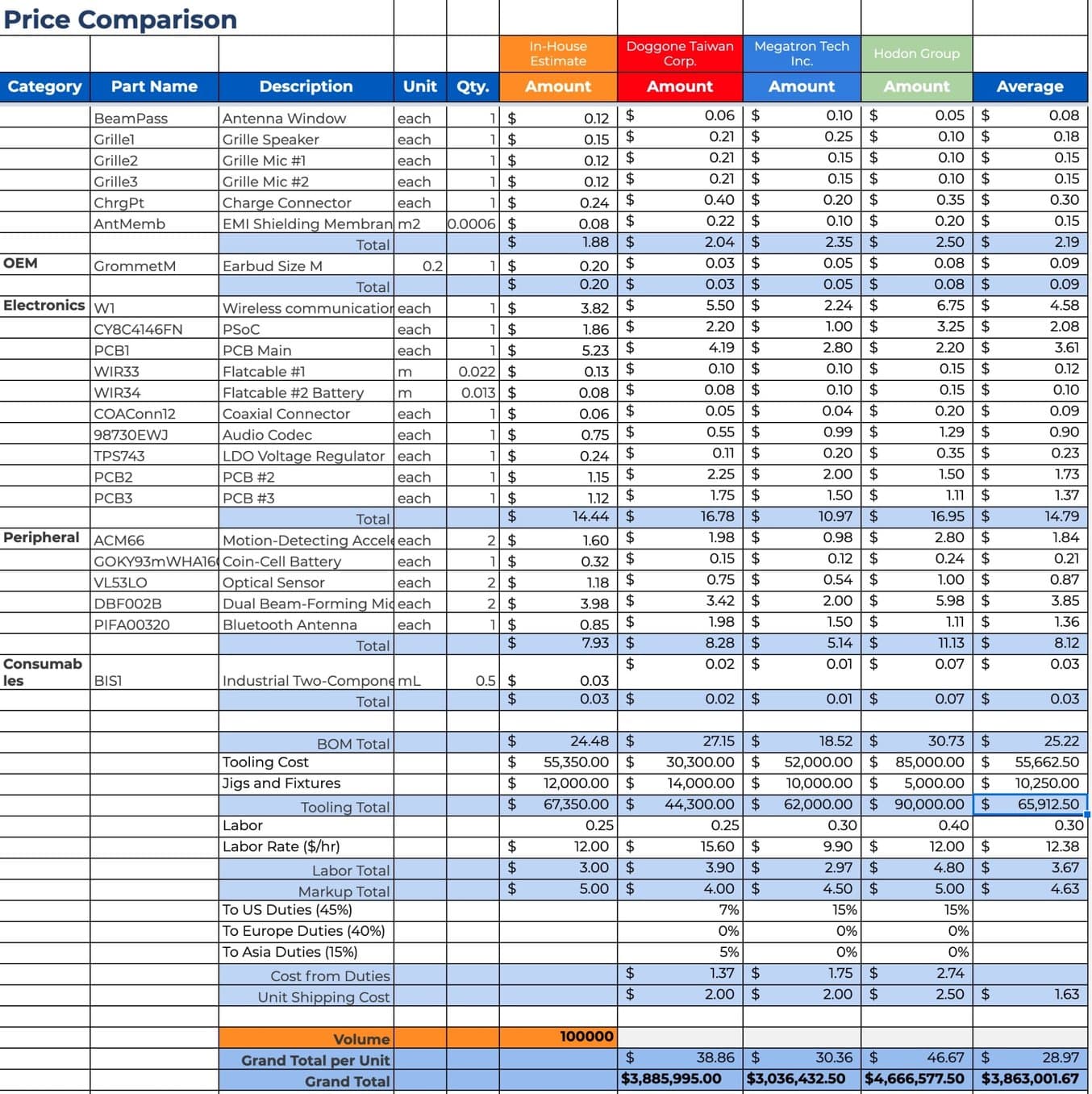

Once quotes are obtained, offered prices for all items of the BOM should be added to a comparison table so that they can be compared and worked on individually. See the sheet named ‘Price Comparison’ in our example.

The total COGS is dependent largely on product costs, fixed costs, and labor costs. The ‘Volume’ cell in the sheet is crucial here: by changing the order quantity it will automatically update the COGS. After all, fixed costs matter less the higher the order quantity. This may give additional insight into the best manufacturer if there is a prospect for scaling up production in the future.

After receiving the initial quotes, it is good practice to contact the different CMs in order to work on the quotes and reduce overall prices. In order to drive total cost down, a great strategy is to focus on the three to five most expensive components. This is the small percentage of the total package that will determine the largest overall benefit.

A single-sourcing deal will also work as an argument in the hiring firm’s advantage. This means that, in contrast with sole-sourcing where only one manufacturer is available to produce a part, a CM is administered an exclusive license to make the product.

Similarly, making the CM aware of competitive quotes can be an incentive for them to come up with a more advantageous offer. And besides component prices, consider bargaining for better warranty, assistance, transportation, and payment plans. Every company deals with negotiators in entirely their own way, so the situation at hand will determine the amount of flexibility with a deal.

5. The Factory Visit

Before deciding on which contract manufacturer to offer a contract, it is critical to do at least one in-person visit to the factories of one to three of the candidates. The reality of the situation overseas will shine a new light on the collaboration. The benefits of a factory visit are numerous:

-

Meeting the team to find out their level of commitment.

-

Inspection of sample products produced by the factory.

-

Seeing the facilities and the machinery in real life gives a detailed idea of their expertise.

-

Getting an idea of working conditions, financial stability, and sensitivity to IP.

-

Access to upper management.

It is common that a dinner is organized between the hiring firm’s representatives and the factory owner or executives. Besides being a convivial way to gain familiarity, this is where discussions will flow towards the signing of the MSA. It is advisable to send along someone from the purchasing department for negotiation, a translator/interpreter, and someone from the engineering department for technical advice regarding the product.

Summary

Choosing a contract manufacturer requires great care, expertise, and an involved team. Rather than a vending machine that provides products on simple inputs such as design drawings and funding, working with a CM is a long-term collaboration involving numerous aspects.

Sending a request for a quote is only one of the key steps to a signed agreement; the importance of communication, negotiation, teamwork, decision matrices, and factory visits cannot be overlooked.